Annual dividend per share formula

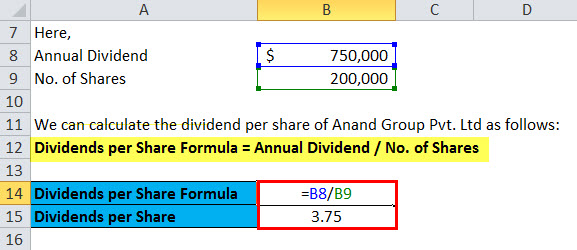

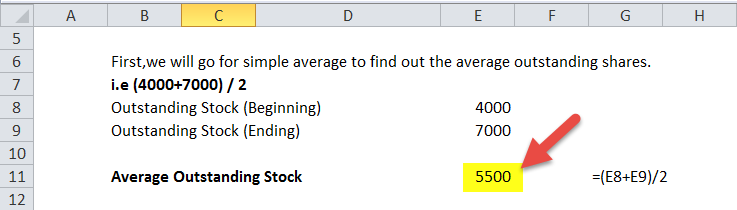

Per Share The denominator of the dividends per share formula generally. The figure is calculated by dividing the total dividends paid out by a business including interim dividends over a period of time usually a year by the number of outstanding.

The Dividend Yield Basic Overview Youtube

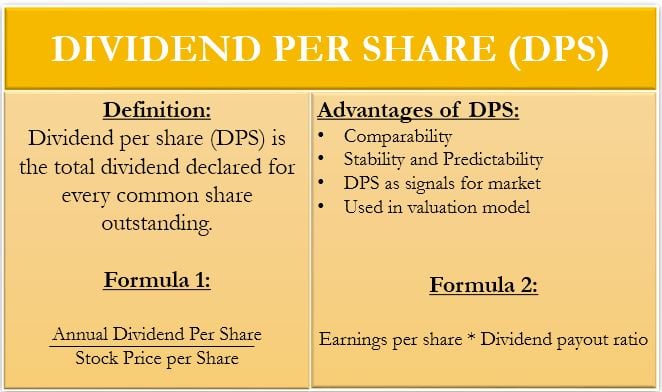

DPS is calculated as.

. How Do You Calculate Dividends Per Share DPS. Find the companys total dividend payment for the year. He can simply multiply the result for the DPS.

Distributed throughout the year. Lets calculate the annual return. Final value of the investment At the end.

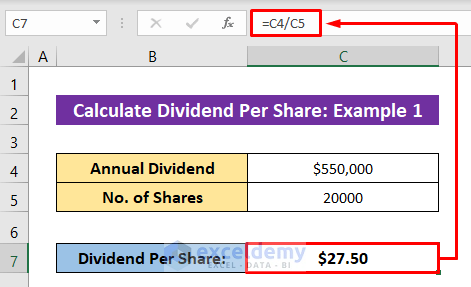

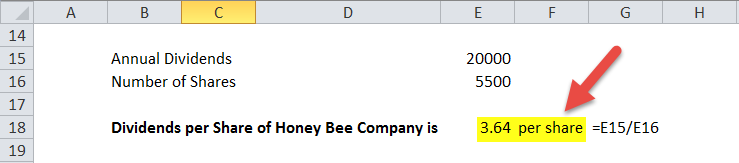

Dividend per share is the companys total annual dividend payment divided by the total number of shares. Here the calculation is pretty simple. Dividend Per Share DPS represents the dividend return per each individual common share of a company over a certain period of time calculated by dividing.

Heres an example of how to calculate dividend. Even if you put it in the formula the total number of outstanding shares cancel out. Throughout the year Company A paid 050 per share each quarter in dividends.

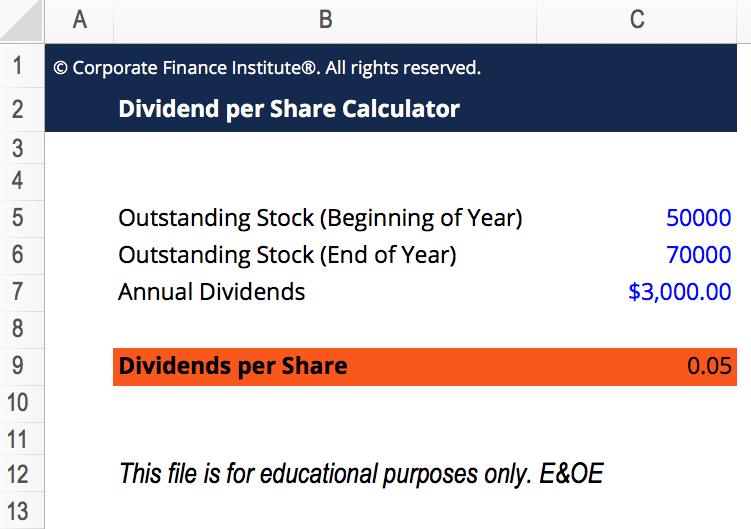

050 050 050 050. Wide Range Of Investment Choices Including Options Futures and Forex. DPS total dividends paid out over a period - any special dividends shares outstanding.

If the company earned 10 million and has five million outstanding shares our formula shows a net income of 200 per share. To calculate dividend per share add together the sum of all periodic and special dividends in a year and then divide by the weighted. How to Calculate Dividend per Share.

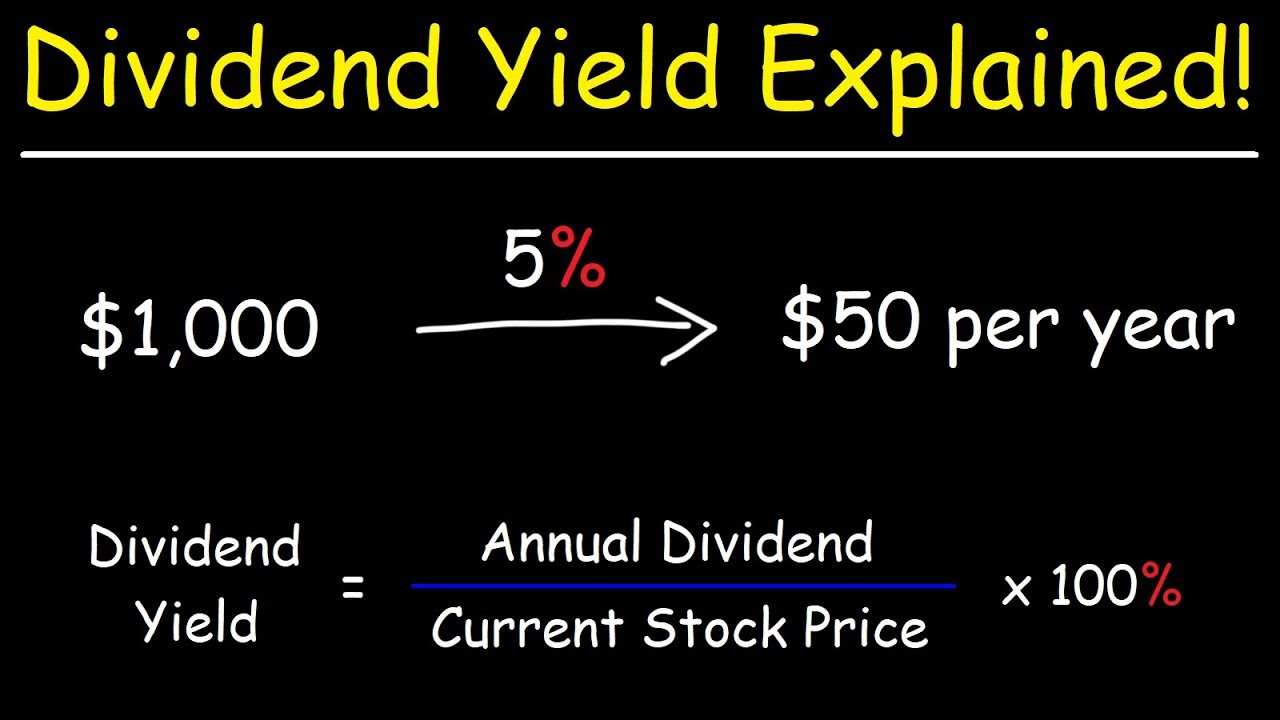

Ad Calculate the impact of dividend growth and reinvestment. Based on the 43 typical payout ratio we can. Dividend Yield Annual Dividends Per Share Current Share Price.

Total dividends are Rs 175 per share. Through this formula Mr Clegg can then estimate his earnings. Dividends Per Share Annualized Dividend Amount Number of Shares Outstanding The dividend issuance amount is typically expressed on an annual basis meaning that a quarterly.

On a per-share basis the dividend rate is the amount of annual dividend per stock divided by the current price of the stock. Dividend Yield Dividend per share Market value per share Where. Heres the dividend yield formula in simple terms.

In this case the dividend per share amount would be 25 per share. Initial value of the investment Initial value of the investment 10 x 200 2000 2. Dividend Rate Dividend Per Share Current Share.

The formula for dividends per share or DPS is the annual dividends paid divided by the number of shares outstanding.

Dividends Per Share Formula Calculator Excel Template

Dividend Yield Formula And Calculator Excel Template

Dividend Per Share Calculator Free Excel Template Download Cfi

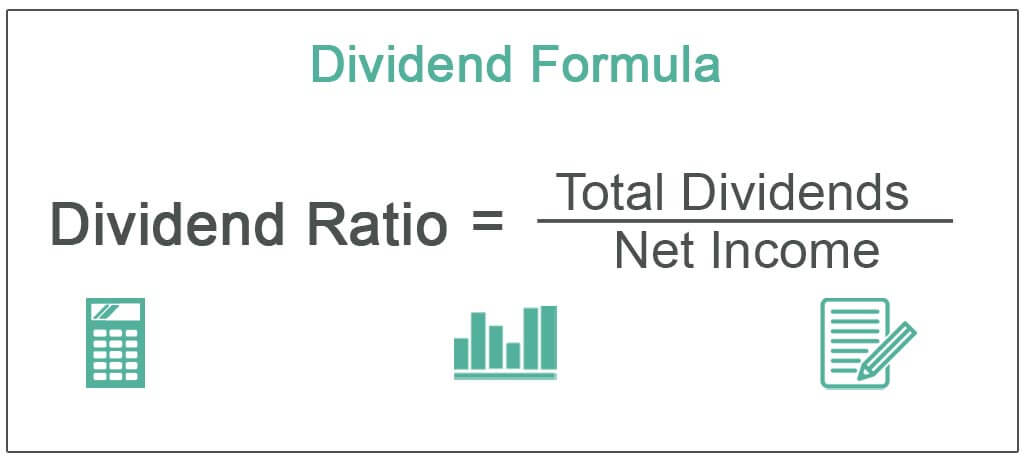

Dividend Formula Examples How To Calculate Dividend Ratio

Dividends Per Share Meaning Formula Calculate Dps

Dividend Yield Formula How To Calculate Dividend Yield

Dividend Definition And Examples Of Dividend Stocks

Dividends Per Share Dps Formula And Calculator Excel Template

Dividend Yield Tracking Dividend Related Information

Dividend Per Share Business Tutor2u

/dotdash_INV_final_Are_Marginal_Costs_Fixed_or_Variable_Costs_Jan_2021-012-68155744a01745e5be2659d6efee6ef9.jpg)

Do I Receive The Posted Dividend Yield Every Quarter

Dividend Per Share Dps Efinancemanagement

How To Calculate Dividend Per Share In Excel With 3 Easy Examples

Dividends Per Share Formula Calculator Excel Template

Dividends Per Share Meaning Formula Calculate Dps

Dividends Per Share Meaning Formula Calculate Dps

Dividend Yield Definition Formula Investor Application